October 24, 2022

For those of you not addicted to regularly throwing your money away on sports betting, a “Trap Bet” is one that is a no-brainer … a sure thing. Except it isn’t. The bookmakers know things that the betting masses don’t and all the smart people like me lose money. As an example, I KNOW that rates are going to continue upward until sometime in 2023 and then we will have a prolonged period of stabilization before the Fed starts cutting. Of course, if my “sure thing” didn’t come to pass, it could cost me some money, so I have sought out some unconventional resources to help me avoid such costly miscalculations. It is those outcomes and resultant strategies that I thought I’d share here.

Following the Real JP

What better way of anticipating rate swings in the interest rate market than to listen to the man himself, JP (Jerome Powell), as well as the pundits who then explain exactly what his comments mean and what rates to expect in the coming years. There is another JP, however, whose comments need little interpretation and whose insight I have found to be right way more than the over-venerated Powell. That would be JP Conklin, the prodigious prognosticator from Penn State who operates from a small building in a sketchy neighborhood near downtown Charlotte.

Hype versus History

From a darkened room on the 4th floor where the luminescence from his six monitors (two of which show ESPN) cast competing shadows against his furrowed brow, this omniscient oracle draws out and reports hard data in the weekly Pensford newsletter. When considered, this newsletter will often find the reader moving against the informed consensus (aka “trap bet”). JP’s methodology is pretty simple - he looks backward to move forward. This JP blocks out the cacophony of white noise from the other JP and his interpreters and instead reports what has happened historically and repeatedly under similar circumstances.

When 36 Equals 8.7

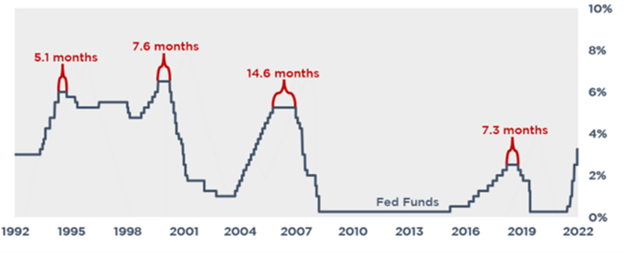

In his October 9th newsletter (which you can read here), JP points out that the market expectations of rates remaining stable for a 36-month period following the final hike in this series of hikes are simply not supported by historical data. The chart below, taken from that newsletter, shows a series of four periods of rate hikes in the last 30 years and measures the time between the final hike in each period and the first cut following. Historically, the longest period was 14.6 months, and the average was 8.7 months. Neither of those is even close to 36 months.

How Much Can I Lose?

That’s a great question and one that the reader can easily quantify. Try this back-of-the-envelope calculation: a $20 MM loan with a 10-year fixed-rate and 25-year amortization has a cost of roughly $16,000 for every basis point (.01%). If you fixed a 10-year rate today and the rates started to move down more quickly than forecast, you could replace that fixed-rate at a much lower fixed-rate. A decline of 75 basis points would cost a borrower about $1.2 MM in excess interest. To arrive at your own estimate, simply adjust the loan amount and possible rate movement.

The Answer / The Opportunity

For borrowers moving into new loans, you might consider the risk of long-term rates moving higher against the risk of locking in. Then compare that risk to those same rates moving lower in the not-too-distant future and act accordingly. Options include:

• partially covering the term or the debt amount through interest rate swaps,

• laddering your swaps, or

• negotiating out / down prepayment penalties of more than three years.

As for borrowers with existing swaps that are substantially “in the money,” partially unwinding the term or amount of your swap is like taking money off the table before your next roll. It can limit undue exposure and generate cash.

In any of these scenarios, just make sure that you’ve got a professional by your side, as such transactions can give a bank an opportunity for additional unseen profit (an additional cost to the borrower).

As for me, I’ve got to go now and Venmo my Bookie. I can’t believe that Bama didn’t cover. I mean, it was so obvious!