March 4, 2025

Internal valuations have evolved. More than 50% of our clients are now using a multiple of their building’s net operating income to derive their share value. This article explores how selecting the correct multiple can be a counterintuitive process.

“As an owner, we like our multiples to be high.”

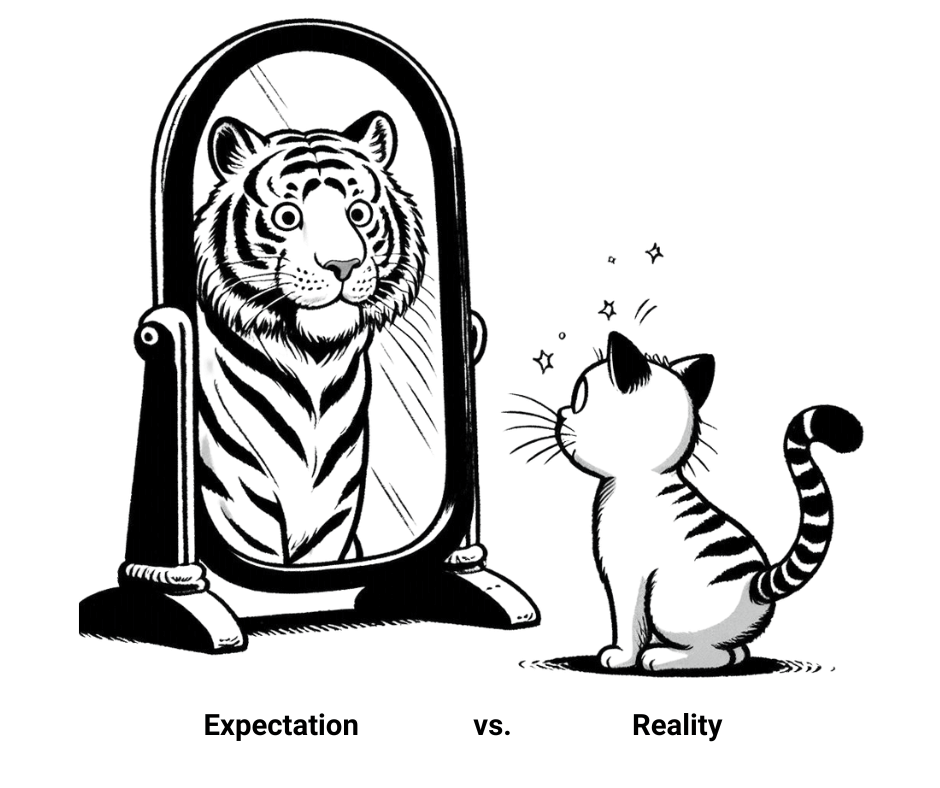

“Higher multiples are great. A higher multiple on my EBITDA makes my practice more valuable. A higher multiple on my real estate means my building is worth more.” It’s not uncommon to hear physician owners follow this logic and apply it to their practice-occupied real estate. Not long ago, I participated in a panel discussion with a physician who was making this very point, stating that, “As an owner, we like our multiples to be high, so we set our cap rate low for buy-ins and buyouts.” Let’s explore an example to help illustrate that logic.

An ophthalmology clinic owned by 10 partners is producing $1MM of net operating income. The group has been using a 10x multiple (10% cap rate) resulting in a $10MM value. Currently, the property has $6MM of debt, therefore creating an equity position of $4MM.

The group is considering adjusting the multiple to align more closely to a market value, which would take the multiple up from 10x to 14x (7.14% cap). Suddenly, the building’s value increases to $14MM. With $6MM of debt, there is now double the amount of equity ($8MM). All 10 partners have $800,000 of equity instead of $400,000. Everyone is a winner! We can stop following the math and assume all these partners lived happily ever after with more income, right? Not so fast.

With MENTES360, we can now understand in granular detail the impact of such changes – and the results might come as a surprise. This change is NOT necessarily good for the majority of the existing ownership and here’s why. As a private practice real estate owner, you are consistently selling AND buying ownership in the real estate entity as new partners join and existing partners retire. While higher multiples are great if you are selling, they are not great if you are buying more ownership. Your purchase price just got more expensive. Every time shareholders leave the real estate entity with an increased buyout price, the remaining shareholders will be making a higher payment. This creates an inflexion point. The shorter the timeframe to retirement, the more motivated you are to increase the multiple. The longer the timeframe, the less motivated you are.

Jumping back to the example above, despite the eventual doubling of equity for the existing partners, the partners with 20 – 30 years remaining to practice received returns that were roughly 30% less than they would have received with a lower multiple. The longer the partners stayed, the worse their individual outcomes became. For groups that are trying to promote retention, increasing the multiple will likely have an undesirable effect, as partners become economically incentivized to retire earlier. For groups that are trying to bring in new partners, the outcome is a little more obvious, as the buy-in becomes more expensive and the returns are diminished.

Above all, when considering changes to valuation methodology, we recommend being able to quantify the effects on an individual level, for both existing partners and prospective new partners. This is why more and more of our clients are turning to MENTES360 for impartial analysis. If you would like to schedule a free demo based on your practice’s situation, please reach out at support@mentes360.com.