August 15, 2022

Sale-leasebacks can be beneficial under the right conditions, but they can also unknowingly bring pitfalls.

What many practices don’t realize is that, in a typical sale-leaseback structure, the doctors who remain in the practice during the term of the new lease realize disproportional benefits than the doctors who retire during the term. And, the sooner a doctor retires, the more they benefit. The real estate, which once helped unify the practice, instead becomes a divisive force that incentivizes early retirement and damages the practice’s long-term productivity and revenue.

Fortunately, there are methods of executing your sale-leaseback AND creating equitable benefits, encouraging continued partner participation in the practice. To learn how, you first need to understand how the inequity occurs.

In a sale-leaseback with a triple net lease, the partners receive a multiple of the annual rent paid. The multiple is determined by several factors, but generally it is the rent income produced over the term of the lease.

Let’s look at a basic example of a sale-leaseback deal:

- A 10-doctor practice agrees to pay annual rent starting at $2MM, with annual escalations of 2% for 12 years, totaling $26.8MM over the lease term.

- The buyer agrees to pay 16 times the starting rent to the sellers. That amounts to $32MM, a cap rate of 6.25.

- There is $14.8MM of debt to be paid off, leaving $12MM in income after the $26.8MM rent payments. Each of the doctors receives their 10% portion, or $1.2MM each.

Assuming all the partners remain in the practice, each one will be responsible for paying 10% of the $26.8MM total rent payments, or $2.68MM each. That’s not, however, what happens in the real world. Rather than having all partners remain for the term of the loan, some doctors will naturally retire and be replaced by newcomers joining the practice.

Imagine two of the doctors retire one year after the real estate sale, another after two years, and another after the third year. With each retirement, the remaining doctors will be left to pick up the retired doctors’ shares of the rent obligation.

This situation causes inequity because the remaining doctors will pay more in rent to get the same benefit as those who paid less. The sooner a doctor retires after a sale-leaseback, the more they profit.

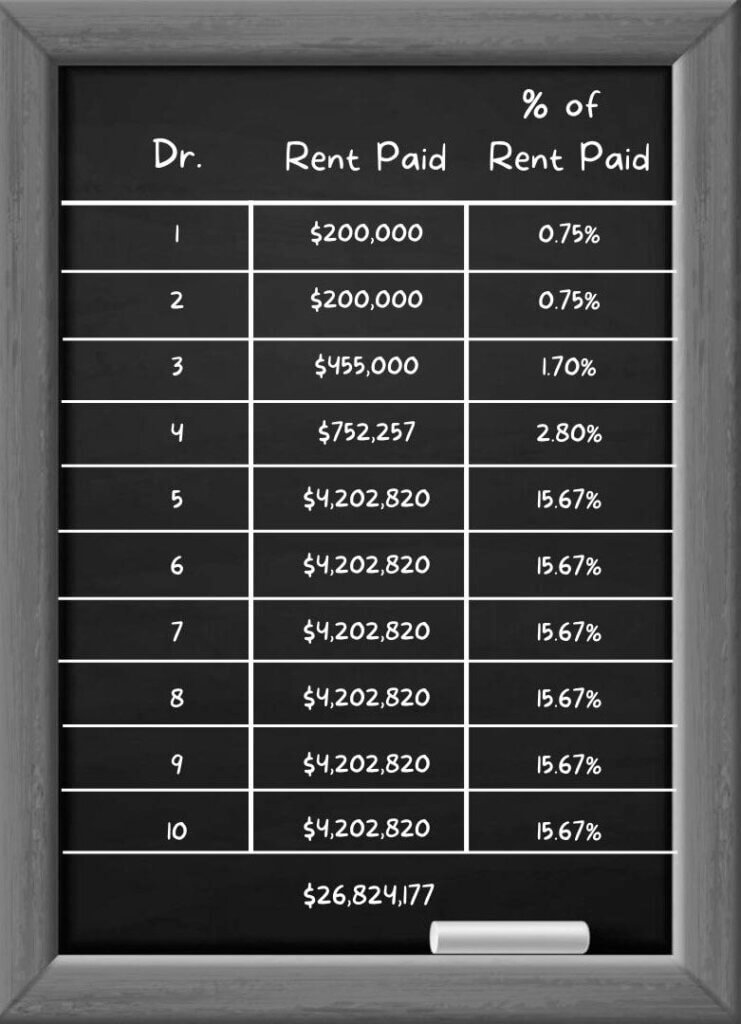

Let’s look at the outcomes:

While each doctor received 10% of the proceeds and should have been responsible for paying 10% of the rent obligation, it didn’t turn out that way after doctors began to retire. Instead, Doctors 1 and 2 received 10% ($1.2MM) of the profits but paid only 0.75% of the rent, while the doctors who remained for the full term paid 15.67% of the rent instead of the expected 10%. The doctors who left soonest – Doctors 1 and 2 – received more than 20 times the return compared to those who stayed with the practice.

Although some of that burden will be offset by new doctors joining the practice, it won’t ever be fully “equal.” Those doctors who stayed will always pay more than those who left early. Meanwhile, the new doctors will bear the burden of escalating rent, without any compensation from the original sale.

Saving the Sale-Leaseback – The Answer

Fortunately, for groups interested in moving forward with a sale-leaseback, newly developed models are now available that can provide an equitable solution. All doctors who pay the lease part of the sale-leaseback can secure their fair share of the benefits.

These models can be applied to any practice, regardless of the unknown factors such as the number of new or retiring partners or the timing of retirement. These solutions will encourage doctors to continue practicing, rather than taking an early retirement.

To learn more about the models available and find out how they can benefit your practice, email our team at solutions@cmacpartners.com.