October 4, 2024

The Two Keys to Keep it Flowing

The All-Too-Familiar Scenario

In 2021, a group of 10 physician partners invested in the MOB that housed their practice. They financed 85% of the $20MM project cost and contributed the remaining 15% in cash. The rents produced cash-on-cash returns to the doctors of over 10% in the first year.

In 2025, two new partners were scheduled to buy in and would have been attributed an ownership share proportionate to their investment against the equity. The new practice partners, however, declined the offer to invest in the real estate and, by doing so, devalued and destabilized the original real estate investment. Without continued buy-in from new partners, there’s no assured source of funding buyouts and, perhaps more importantly, the group is less likely to renew its lease once the original partners become the minority.

“Just Not Interested in Real Estate”

That’s the conclusion drawn by many existing partners when they witness an unwillingness of those younger doctors to buy in. After all, “They are getting the same deal we got.” But are they? In fact, the investment opportunity has failed the “A&A Assessment” – Affordability and Attractiveness. The real reason new docs might pass on buying into the real estate may not, in fact, be a lack of interest.

What’s The Problem?

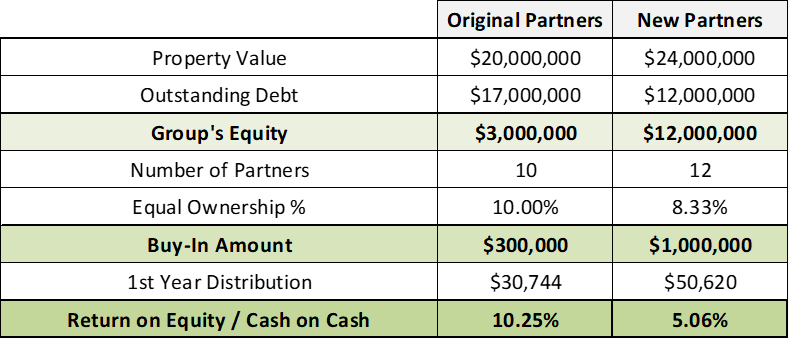

Let’s take a look at what is being offered to the new docs. As the valuation of the group’s real estate portfolio grows and the entity repays its debt obligations, the buy-in for a new partner often increases and can become burdensome. Assume that within those years, the property has appreciated by 20% and the loan has been paid down by 20%. The property now has a value of $24MM with just over $12MM of debt (see Table 1). What was previously a $300K investment for a 10% share and 10% initial return is now a $1MM investment for an 8.33% share and a 5% return. Not the same deal at all.

At the national CPOMP conference in 2022, James Winchester, the moderator of a session on operating agreements, posed a simple and singular question to a group of senior doctors who owned their property which in turn gave rise to the A&A Assessment. “If you were looking to buy this property today, would you do so if you had to come up with 50% of the purchase price in cash for a return of less than 6% or would you pass? If the answer is 'pass,' why would you expect a different answer from the new docs?"

Not interested or not interesting?

The Link Between Attractiveness & Affordability

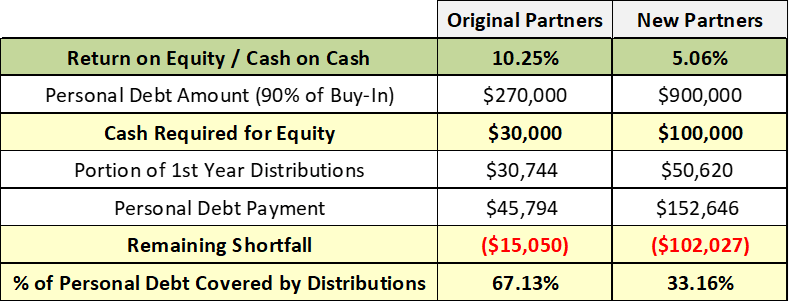

There aren’t many new partners who have $300K in liquid assets lying around, let alone $1MM. Subsequently, these new partners often require personal loans from lenders to finance their buy-ins. In some instances, the group may even internally finance these buy-ins, which often detracts from the returns received by the existing partners. In either instance, it results in a note being due to the bank or to the existing partners. The ability of the new partner to cover this debt obligation becomes paramount.

Covering this personal loan payment can be much less demanding on the new partner if the real estate entity is generating greater returns and distributing more cash annually, relative to the buy-in amount. In other words, if the real estate entity has a better cash-on-cash return, the partner can cover more of their personal debt with the distributions being received from the real estate (see Table 2).

So, the last question becomes how do we improve the cash-on-cash returns that the real estate entity is generating? There are three items that primarily impact the cash-on-cash returns that a partner receives without negatively impacting the returns of their partners:

1. The Rental Income

2. The Loan-to-Value

3. The Loan Terms (Interest Rate & Amortization)

Assuming the rental income is in line with fair market rent, this item isn’t something that you’re likely going to adjust a great deal because it cuts into the practice’s profitability. Thus, the property financing becomes the primary tool to positively impact the partners' returns without adversely affecting existing partners.

If you’re curious to learn your cash-on-cash returns, and whether they could potentially be enhanced to make the investment interesting, please reach out to solutions@cmacpartners.com to find out more and receive your own complimentary analysis.