July 17, 2022

“Perfection is the enemy of progress.” – James Winchester

I have profoundly blurted out that quote a few times in recent meetings and have since claimed it as my own. Being a quintessential British man, I can get away with stuff like that. Little do others know, it was at one time said, allegedly, by Winston Churchill. Nonetheless, it is quite fitting when talking about physician-owned real estate.

Sometimes, to consummate a transaction, an unfamiliar word touches everyone’s lips: Compromise. (Shocking, I know.) This was the case for one orthopedic group in the Southeast U.S.

As relative newbies to real estate ownership, the group naturally wanted to drive partner participation by making the investment as enticing as possible. To achieve that, they offered all physicians an ownership interest in perpetuity, with the caveat that each owner would be relieved of voting rights when they retired from the practice. For a few years, their plan was seemingly going well, and, as the group expanded, it was able to replicate the same ownership structure for their new buildings.

Before long, the partners noticed a problem:

Several new doctors had joined the practice and were eager to get involved in the real estate investment. But which property? And to what extent? And how would those shares be valued? To make matters worse, some of the original partners had retired, causing the real estate’s ownership to diverge from that of the underlying practice. Challenges began to emerge:

1. Divergent Decisions.

Lease renegotiations, tenant improvement, and general building upkeep became contentious. Every transaction ended in a disagreement, making it harder to make decisions which were in the best interests of both groups of stakeholders.

2. Unbalanced Liability.

The practice guaranteed the debt obligation, but that only benefited the real estate ownership group that was growing less and less reflective of the practice.

3. Where is the Value Coming From?

Because most of the investment is dictated by the practice lease, non-real estate owners in the practice started to raise questions as to why that value was given away.

With these issues in mind, the orthopedic group was in a quandary. How could they attract new partners while honoring the initial offer that had been afforded to the legacy owners? After consulting with CMAC, they learned that a restructuring could create an attractive proposition for stakeholders on both sides.

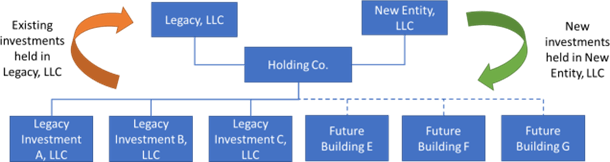

As outlined in the diagram, the orthopedic group rolled its ownership interest into a holding company. No more picking and choosing investments by the partners. By splitting the ownership interests between the new entity and the legacy owners, the partnership allowed the legacy owners to maintain the equity and the investment they had been promised. Meanwhile, any new investment would be made through the New Entity, LLC. In essence, this allowed the group to create ownership parameters in the new LLC that mitigated any divergence from the practice, while not adversely impacting what had already been agreed upon. What a great compromise.

So back to good ol’ Churchill. This may not have been what he had in mind when he coined that phrase long ago, but it certainly is representative of the challenges many groups face with their real estate investments today. By striving for perfection and to entice partners, groups sometimes enter into operating agreements which are unsustainable in the long run. Not every group has the option to start fresh, and there can be some good reasons that certain provisions were established. If you can find ways that appease existing owners and enhance the sustainability of the investment, perhaps perfection isn’t what is needed anyway.