October 20, 2023

Like Ozempic, the drug developed to aid diabetics but found to have great benefits in weight loss, the CPOMP Physicians’ Equity Fund, capitalized by physicians, was developed with one purpose in mind but has been found to have other very useful applications. Chief among those is the creation of equality among physician partners in a real estate venture.

Until now, whenever some partners within a group could not afford to fund their full equity portion, the most common remedy would be for other partners to take on a larger portion of the ownership. That would mark the start of the immediate creation of the “have and have not” classes. Other issues would then arise and exacerbate with the disproportionate division of distributions and an enlarged buyout of those partners at retirement that could stress the remaining cash flow.

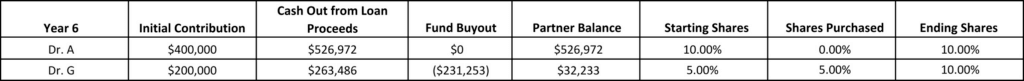

By way of example, let’s assume that there are 10 partners building a $20 million MOB that has an equity need of $4 million (20%). For the doctors to have equal ownership, each would have to contribute $400,000. In this case, four of the doctors have only $200,000 each to contribute between cash on-hand and personal loans, creating an aggregate shortfall of $800,000.

The Old Way

Typically, you might have a couple of the more senior doctors step in and take on an additional $400,000 each to cover the $800,000 shortfall. The division between the doctors would then have two doctors owning 20% each, five doctors owning 10% each and four doctors owning 5% each. Moreover, there may be no clear path back toward equalization. And the eventual buyout of the two doctors, who together now own 40% of the total shares, may require more cash than the others then have available.

With the Fund

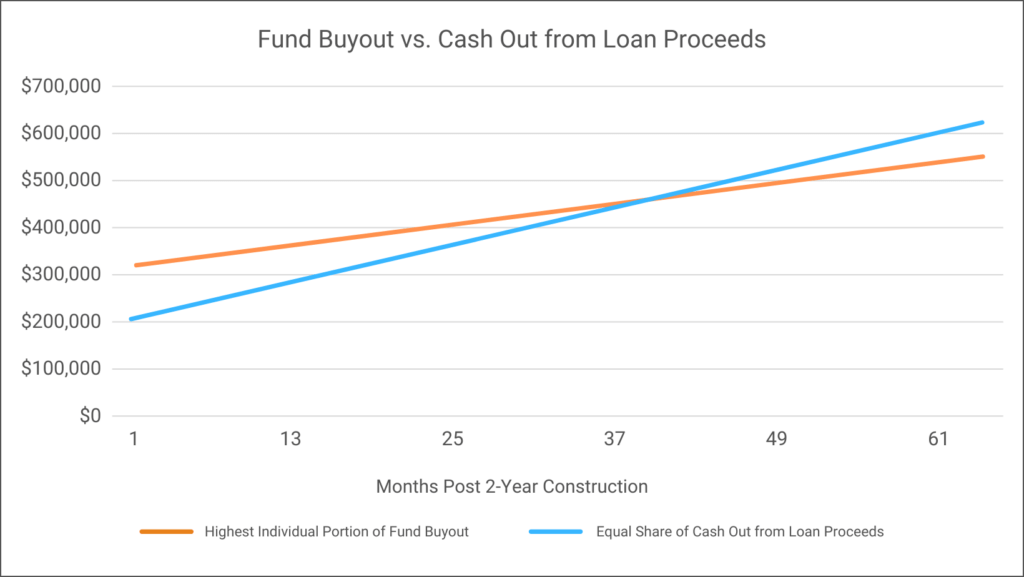

Rather than have other doctors stepping in to fund the shortfall, the CPOMP Physicians Equity Fund could be brought in as a joint venture (JV) partner with shares proportionate to the equity contributed. Under the JV Agreement, the Fund would have its voting rights flow through to the doctors whose equity it is replacing subject to certain protective provisions. The JV Agreement would call for a buyout of the Fund within six years. The JV is structured so that the buyout should be able to be funded by a refinance within two or three years from completion of construction or acquisition. When that happens, the doctors who fully funded their shares will receive 100% of the cash out from the refinance. The Fund will receive its proportional share capped by the predetermined buyout, and any residual over and above that buyout will go to the doctors. Those doctors would also be responsible for any shortfall. At the completion of the refinance and buyout, all partners will own equal shares as shown in the graph.

The CPOMP Physicians’ Equity Fund provides an alternative that keeps the fabric of the partnership united rather than pulling it apart. For more information, contact the Fund General Manager Andy Johnson at andy@cpompfund.com.