August 29, 2022

Nearly 100 Docs Make Millions Available

A collection of doctors representing a wide array of specialties has created the CPOMP Physicians’ Equity Fund 2022A (PEF). This new fund is aimed at smoothing the path for other doctors to develop and acquire real estate. PEF offers unique advantages and better economic outcomes to the doctors than other equity sources.

One significant difference is that PEF stays in as a partner only for the time needed instead of being a “forever” partner like typical equity sources. This is because the PEF equity is contributed with an agreement in which the doctors buy out the PEF partners at a future date at a predetermined value, which can usually be funded through a refinance after stabilization. In the case of a sale, the doctors do not share proportionately with the PEF partners, but instead pay the predetermined price.

Two Big Differences: Dollars and Control

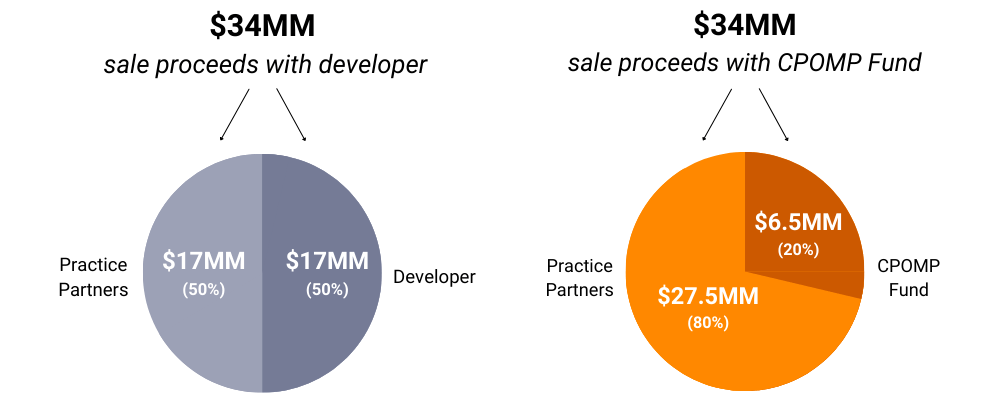

Until now, the most common source of supplemental equity when building an owner-occupied project is the developer. Usually, that equity comes with an agreement in which the developer shares all proceeds in proportion to its share of the total equity. On the surface, that seems fair and reasonable, but it is not. With the signing of the lease by the practice group, the building value increases substantially. While that increase is caused solely by the practice group, the incremental lease value along with economic appreciation must be shared with a partner that had no part in its creation. PEF is not entitled to share in those increases and looks only to the predetermined value that is typically a fraction of that leased value.

Andy Johnson, the Fund’s Manager, provided the example of a large multi-specialty group that built a $40MM building with the developer as its 50% partner.

“The building was sold shortly after completion, based upon the practice group’s lease, for a sum of $74MM, and the $34MM gain was shared equally with the development partner receiving $17 MM. Had the fund provided the equity, the doctors would have paid out $6.5MM instead, ending up with an additional $10.5MM. Whether the project is $50MM or $5MM, the proportional differences when using the Fund are the same.”

Johnson went on to point out that in the case where the building is held rather than sold, the difference remains, but over longer periods of time. That difference grows with every annual rental increase and the appreciation of the building. “The sooner the doctors can shed their equity partner, the sooner they start to see greater returns, and, in most cases, that is only possible with the PEF.”

Beyond the dollar differences, the most frustrating and sometimes devastating issue in the traditional developer partnership is the loss of control. Johnson referred to several cases in which the non-physician partner blocked the physicians from taking action that may have been in the best interest of the practice, but not in line with the objectives of the developer. For example, Johnson spoke of a large orthopedic group with a 50% development partner who was intent on paying down debt. When the equity piece got so large that it prevented new doctors from buying in, the practice sought to refinance. This would provide cash out to the current partners, reduce the equity, and create affordable buy-ins. That refinance was blocked by the developer whose vote was required and who preferred to pay down debt.

“With the PEF, control on all major issues such as sale or refinance stays in the hands of the doctors subject to the takeout provisions of the agreement.”

Johnson was quick to point out that the PEF is particularly unique because it is “By Doctors and For Doctors.” According to Johnson, these are investors who understand their colleagues’ needs and objectives and are on the same wavelength. “It makes for better outcomes.” It really does seem that the emergence of the PEF may mark the dawning of a new age for physician development.

For further information on the Physicians Equity Fund, go to www.CPOMP.org/fund.