July 13, 2022

Debt = Leverage = Sustainable Investment

When members of a practice group decide to become investors in the practice real estate, there are two primary questions they need to ask:

- Can I AFFORD the investment?

- Will the investment produce an ATTRACTIVE return?

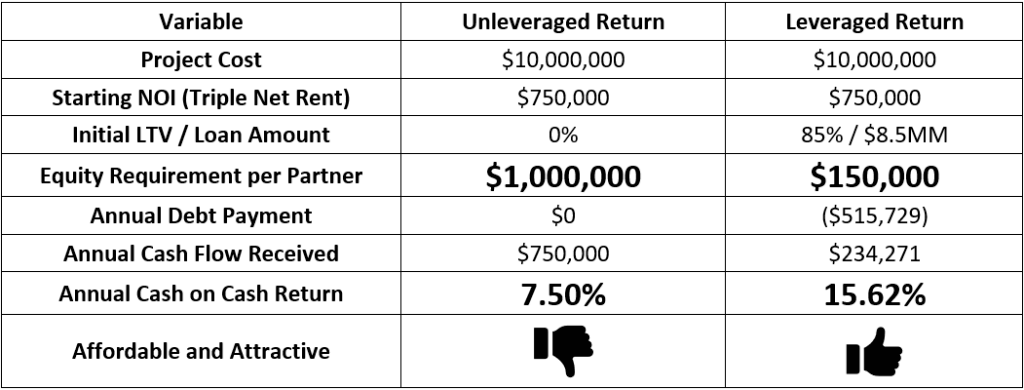

The single, essential element that will likely provide positive answers to both questions is leverage. Investopedia defines leverage as “the use of debt (borrowed funds) to amplify returns from an investment or project. Investors use leverage to multiply their buying power in the market.” For independent physician groups investing in a new owner-occupied project, debt typically accounts for at least 80% of the total investment. The table below assumes a $10MM investment by a 10-partner group and demonstrates that, without leverage, this investment is probably not affordable to most and is certainly less attractive.

While virtually all groups leverage their investments from the outset, opinions vary on the ongoing leverage that should be applied as the investment matures. If your group is dynamic and reflects the practice ownership in that new doctors are looking to buy in and retiring doctors are expecting to be bought out, the answer becomes quite clear. You need to be able to bring in the new partners by keeping the investment both affordable and attractive. Groups often make things more difficult for themselves, however, by treating the building investment as if each doctor were the sole owner paying down debt. This practice puts makes it harder for the group to attract new doctors.

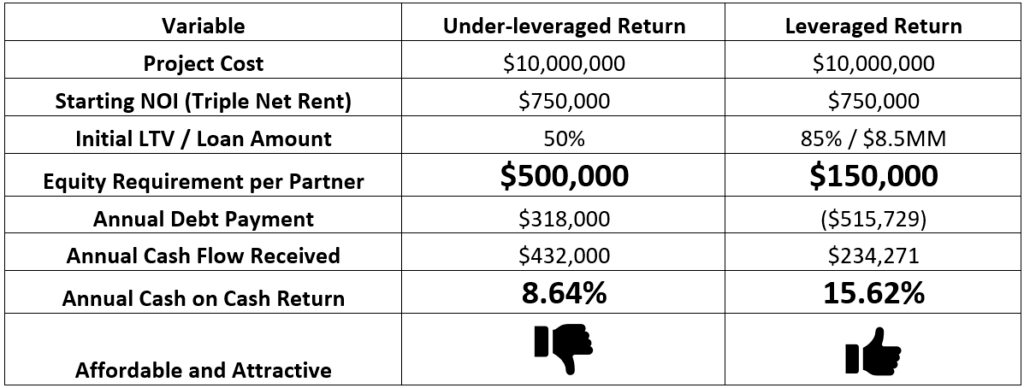

Now, let’s look at the same investment, but assume that it’s paid down to where the debt is 50% of the value. The table below depicts the investment the new doctors are expected to make. It is over three times more expensive, with a cash return that is only about half of what the senior doctors received. The investment is no longer affordable or attractive.

Yet if you asked that same group of senior doctors what amount of financing they would take out if they were buying that same building again, invariably, it would be the same amount of financing as they applied originally. A comparable investment opportunity, achieved through a comparable amount of leverage, should be made available to those incoming doctors if the investment is to remain sustainable.

Other Important Considerations of Debt

The “Whom Should I Owe” Conundrum

“If your bank loan is paid off, are you debt-free?”

Counterintuitive as it may seem, the answer is “no.” Why? Upon a physician’s retirement and buyout of the real estate, their equity is converted to a note payable debt obligation.

Next question: “Would you rather have more bank debt or more partner debt?”

This question is even trickier. Generally, the terms of bank debt are superior to partner debt. While a bank can typically amortize debt on a 20- or 25-year schedule at interest rates of Prime or below, partner buyouts typically follow an accelerated repayment schedule over five to seven years at a rate greater than Prime. This often becomes problematic from a cash flow perspective, as the balance of long-term debt shifts to shorter-term debt at higher interest rates.

Asset Protection

Groups that can secure bank debt without personal guarantees often view stripping equity out through a cash-out distribution as a way to secure at-risk equity. To learn how, read the case study “Reducing Personal Risk While Increasing Real Estate Debt” found at CMACPartners.com.

Impact of Stripping Out Equity

Re-leveraging the investment typically involves cash distributed to the partners. With a quick back-of-the-envelope calculation, we can see that if the return received on the funds extracted is higher than the interest rate on the bank debt, the partner’s economic position will improve by extracting the funds.

Banks are among the most risk-averse lending institutions. For a low-risk investment, such as a secured mortgage loan to a strong medical client, they typically accept a low return on that capital. Therefore, a mixture of diversified investments should yield a higher annual interest return to the physician-investor than the interest rate paid on the bank debt. Furthermore, cash-out refinance distributions are often tax-deferred transactions, which allows the partner to earn interest on proceeds extracted today to manage the taxable impact upon the sale of shares that trigger that tax event*.

Leverage: Your Tool for Growth

Despite the conflicting interests and timelines that impact physician-owners in an independent medical practice, leverage can help your practice maintain a consistent and sustainable investment appealing to the interest of new owners, as well as perpetuating the financial health of the existing shareholders. Balancing debt and equity is essential for managing stakeholders and supporting your practice’s long-term success. To learn more about finding the right level of leverage for your investment, contact solutions@cmacpartners.com.

*CMAC is not a certified CPA film and will not be held liable as a tax advisor. This article is not intended to provide tax recommendations associated with a cash-out event.