February 29, 2024

When it comes to appraising the value of commercial real estate, it's important to recognize that it's more of an art than a science. Describing appraised value as anything other than fifty shades of gray would be misleading. Appraisals are nuanced and multifaceted. According to the Federal Deposit Insurance Corporation (FDIC), an appraisal is nothing more than an "opinion as to the market value." In the realm of opinions, absolutes are elusive. Unlike weighing an object on a scale, appraisers utilize data to form their opinions, and the way they interpret that data shapes their perception of value.

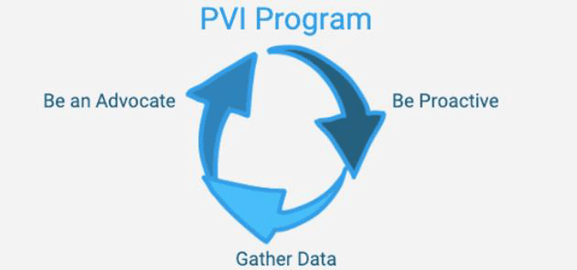

While the subjective nature of appraisals may seem daunting, there are proactive steps one can take to ethically represent a property in its best light when supported by credible data. Although these strategies may not guarantee a substantial increase in value every time, following these guidelines significantly reduces the risk of receiving lower-than-expected outcomes. Let's revisit the steps comprising CMAC's Proactive Valuation Improvement (PVI) Program:

- Be Proactive: Initiate contact with your lender to identify the appraiser assigned to evaluate your property. Once you know who you will be working with, do your homework. Make sure they have pertinent experience evaluating your specific property type (e.g., medical office building, ambulatory surgery center, etc.). A quick Google search goes a long way, but don’t be afraid to reach out directly to the appraisal group to get more detailed credentials. It's crucial to assess whether the selected appraiser has relevant experience early on such that you can ask the bank to rebid the assignment. Do not hesitate to challenge the lender's choice or ask clarifying questions.

- Gather Comprehensive Data: The appraiser will request specific documents critical for accurate valuation. This will be an exhaustive list that may include tax returns, income statements, balance sheets, rent rolls, leases, past surveys, favorable appraisals, or detailed building expenses. Offering comprehensive information significantly enhances the accuracy of the appraisal. Ensure that you communicate any property improvements, from generators to HVAC upgrades, as well as historical costs. Never assume the appraiser can accurately estimate construction costs without your input. It may be time-consuming and cumbersome to dig up all of the requested information, but it will be well worth the time investment with a positive appraisal outcome.

- Be an Advocate: Appraisers commonly use three methods to determine a building's value: Cost Approach, Income Capitalization, and Sales Comparison. While the first two may lack certain data points for validation, the Sales Comparison approach relies on recent market transactions. Make your appraiser aware of similar buildings in your area that have been recently built or sold at favorable values. Illustrating the growth and development in your locality can be a compelling argument. Further, most appraisers are unbiased in their approach, and can only work with the data that’s been given to them. If they have not received a piece of information then an assumption is used to fill in the blank. That is to say, the reflected value will only be as good as the data provided.

Highlighting the impact of these strategies is best exemplified by our work with OrthoArkansas. This real-world application of the PVI Program not only enhanced the group's appraisal values but also played a pivotal role in preventing a construction project from collapsing.

By adopting a proactive approach, providing relevant data, and building rapport with your appraiser, you can significantly influence the appraisal process, ensuring your property is assessed at its true market value. Schedule a meeting with our team to see how this process can work for your group.