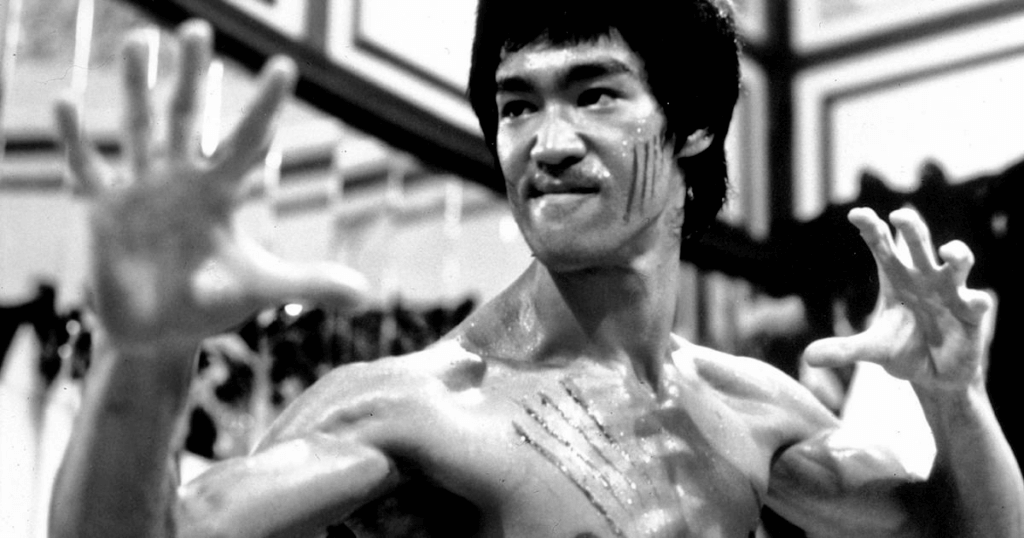

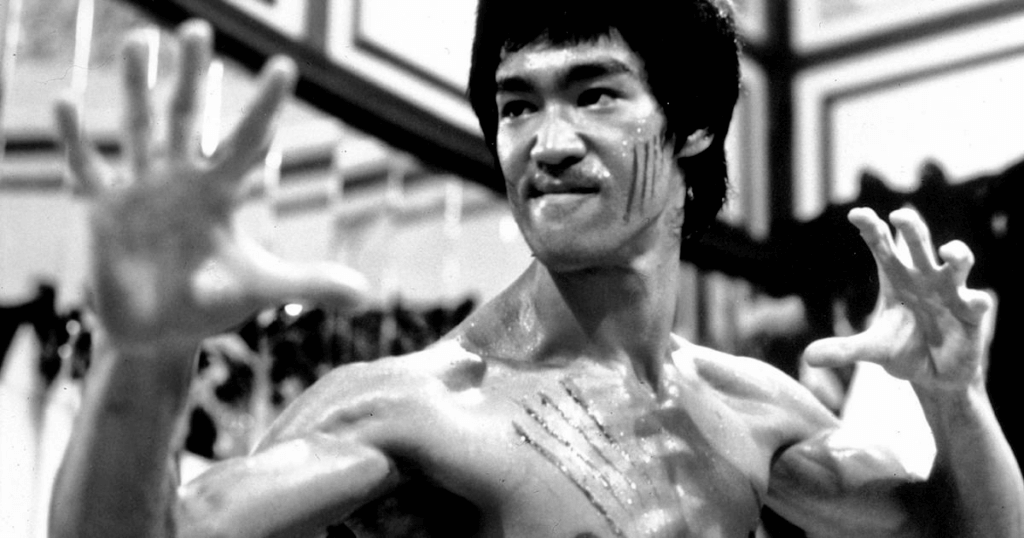

As the great philosopher, Bruce Lee, once said, “There are no limits. There are only plateaus, and you must not stay there. You must go beyond them.” The same can be true when it comes to financing your debt.

Here at CMAC, medical owner-occupied real estate financing is our bread and butter. But as the years go by, we’ve increasingly been asked to go beyond our core capabilities to bring the same results to other types of financing, such as debt to purchase equity ownership shares of surgery centers.

While every medical practice we work with comes with a unique set of circumstances and obstacles, obtaining loans for the purchase of equity presents a particular challenge. Bank underwriting for equity loans is quite different than for real estate mortgage loans. That’s because most banks don’t consider ownership shares to be appropriate collateral. Nevertheless, CMAC’s tried-and-true RFP process has been shown to produce excellent results in all cases.

Recently, we put that process into practice for a prominent nephrology group of middle Tennessee. Nephrology Associates was hoping to improve the terms of its equity loan used to finance a joint venture with Fresenius. The group already had solid financing with its local lender and wanted to keep some business with that bank. The doctors asked if CMAC could apply the same RFP process we use for real estate debt to their equity loan: pre-underwriting the credit; custom crafting a loan structure; explaining the request to a dozen or more of the most likely lenders; and negotiating all the terms to the doctors’ best advantage.

Our team decided to accept the challenge, and the results speak for themselves. We secured a loan proposal which improved the group’s annual cash flows by over $500,000, reduced individual personal liability of the physician-owners by 25%, and lowered the interest rate by 75 basis points (0.75%). While the incumbent lender was disappointed to lose the equity loan from its balance sheet (nothing a good bottle of smooth Tennessee Whiskey between two old colleagues couldn’t ease), they were pleased to retain the operating accounts of the practice.

We faced a different kind of challenge with First Settlement Orthopedics of southeast Ohio. The doctors held shares of a surgery center individually but wanted to transfer that ownership to the practice for tax-advantage purposes. To complicate the challenge, the practice wanted to secure financing that would cover the entire cost of the share purchase with no personal liability to the doctors. On top of it all, this needed to be completed by year end to avoid tax consequences for the group.

It was a tricky request, and one we knew banks would be reluctant to entertain. After all, 100% of the loan proceeds would go into the doctors’ pockets while the practice (the borrower) went into debt. But we felt confident that by applying our expertise and market knowledge, we could get the job done quickly. And indeed, on December 30, we closed on ten-year financing with a rate just over 3% and no personal guarantees.

In an ever-changing market, CMAC is continually adapting its competencies to expertly provide the services clients need today and take on the challenges of tomorrow.

As the great philosopher, Bruce Lee, once said, “There are no limits. There are only plateaus, and you must not stay there. You must go beyond them.” The same can be true when it comes to financing your debt.

As the great philosopher, Bruce Lee, once said, “There are no limits. There are only plateaus, and you must not stay there. You must go beyond them.” The same can be true when it comes to financing your debt.