March 28, 2023

The purpose of this short memo is to provide an update on what CMAC is seeing in terms of movements in long-term rates. This movement may positively affect any upcoming financing.

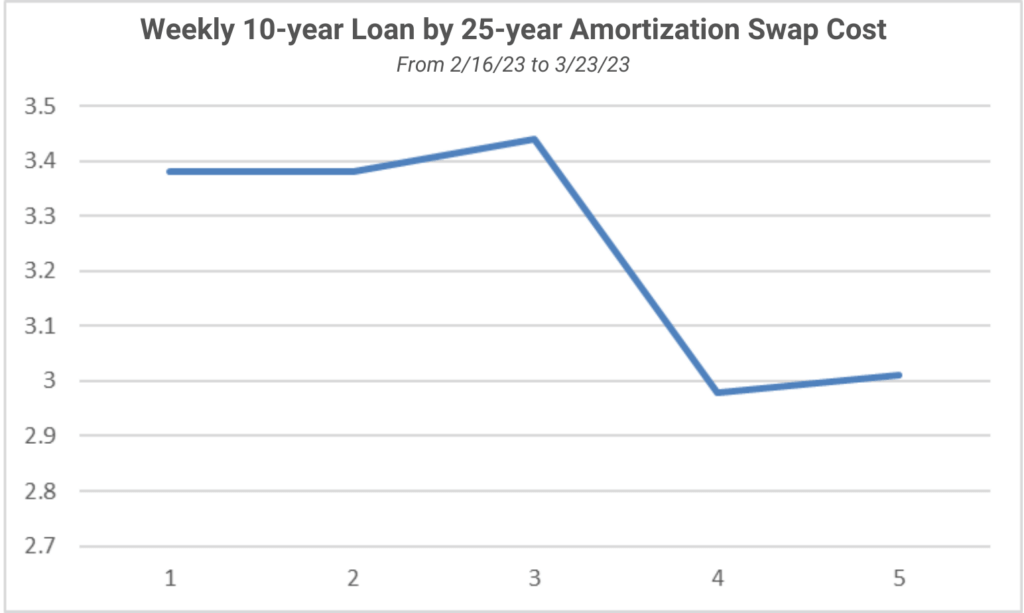

1. A reduction in long-term fixed rates - Since the Silicon Valley Bank (SVB) failure, rates have had a precipitous drop of nearly 50 basis points (0.50%). We cannot predict the future and can only assess that today’s cost of funds are more favorable than the previous quarter.

2. A continued aggressive lending posture - Banks are sitting with significant capital that needs to be deployed. At this time, we have seen a smattering of banks tighten underwriting while most have remained fairly competitive with attractive spreads.

3. Because the SVB failure has affected banks so differently and the responses by each bank are quite diverse, the best outcomes can only be assured through an expansive RFP process to encompass at least 15 to 20 banks.

If your group is planning any real estate projects in the near future, we'd be happy to discuss strategies on how to take advantage of this unexpected drop in interest rates.

Schedule a meeting or email mariela@cmacpartners.com with your availability.